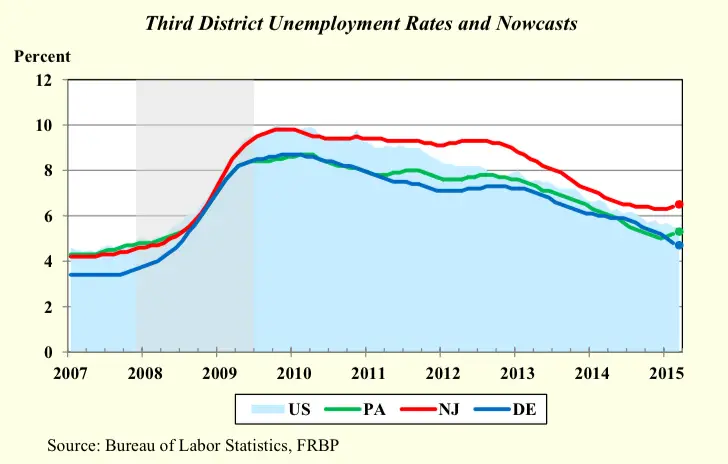

The Federal Reserve Bank of Philadelphia is forecasting a lower unemployment rate for March. The bank also released an economic overview showing the First State to be faring well when compared to other areas in the territory of the bank during the first two months of 2015.

The Philadelphia Fed district includes portions of New Jersey and Pennsylvania, as well as the entire state of Delaware.

Bank researchers, expect unemployment rates for March to decrease from 4.8 percent to 4.7 percent in Delaware and increase from 5.2 percent to 5.3 percent in Pennsylvania and from 6.4 percent to 6.5 percent in New Jersey.

During February, the national unemployment rate was unchanged at 5.5 percent. The Philadelphia Fed releases the unemployment forecasts, due to the lag time between the release of the federal unemployment figures and the state percentages. State unemployment figures are typically released around the 20th of the month.

The bank’s Tri-State Tracking report for February showed job growth in the state running at 2 percent, well above the 1.4 percent and 1.3 percent growth numbers for Pennsylvania and New Jersey respectively.

However, workforce participation ran a couple of percentage points below New Jersey’s figure and slightly above the Pennsylvania number.

The workforce participation figure can be affected by discouraged workers no longer seeking employment or a growing percentage of retirees.

Growth in the number of relocating retirees appears to be taking place in Kent and Sussex counties, both of which have low property taxes.

Income growth in the fourth quarter of last year was running at a 4 percent annualized rate, comparable with other states in the Philadelphia Fed territory, but slightly below the national rate.

That was good news for the state. Delaware was the only state in the nation to see wages decline in cash terms over the past several years, according to a recent story in the respected British publication, The Economist.

Also when it came to the percentage of individuals who, have benefitted the most from the economic recovery, Delaware lags the nation. Despite its reputation as a trust haven and the ancestral home of the duPont family, the state remains below the national average in the percentage of those earning $1 million or more a year.

Delaware has a high personal income tax rate to balance of the lack of a sales tax and low property taxes. At the same time, the wealthy have the option of living slightly more than half of the year in Florida, a state with no income tax. Cited in the story were a number of factors, including court cases moving out of state, the crime rate in Wilmington and the loss of both auto plants by 2009.

Delaware did see building permit activity running above national figures as of February of this year. By contrast, Pennsylvania was running below the national percentage, with New Jersey near the U.S. rate.